Discover the best time to exchange currency in Vietnam with our comprehensive guide. Learn how to save money, avoid fees, and find the best rates for your travel or business needs.

See moreCurrency exchange is a vital service for travelers, businesses, and anyone dealing with international transactions. Whether you are planning a vacation abroad, buying products from another country, or sending money to family overseas, understanding how currency exchange works can save you significant time and money. This comprehensive guide explains the basics, highlights the best practices, and helps you make smart financial decisions.

What Is Currency Exchange?

Currency exchange refers to the process of converting one nation’s currency into another. For example, exchanging U.S. dollars (USD) to euros (EUR) allows you to spend money in Europe. The exchange rate determines how much of one currency you get for another, and these rates constantly fluctuate based on global market forces such as supply and demand, economic stability, and political events.

Key Players in Currency Exchange

-

Banks and Financial Institutions: Traditional banks offer currency exchange services with reliable security.

-

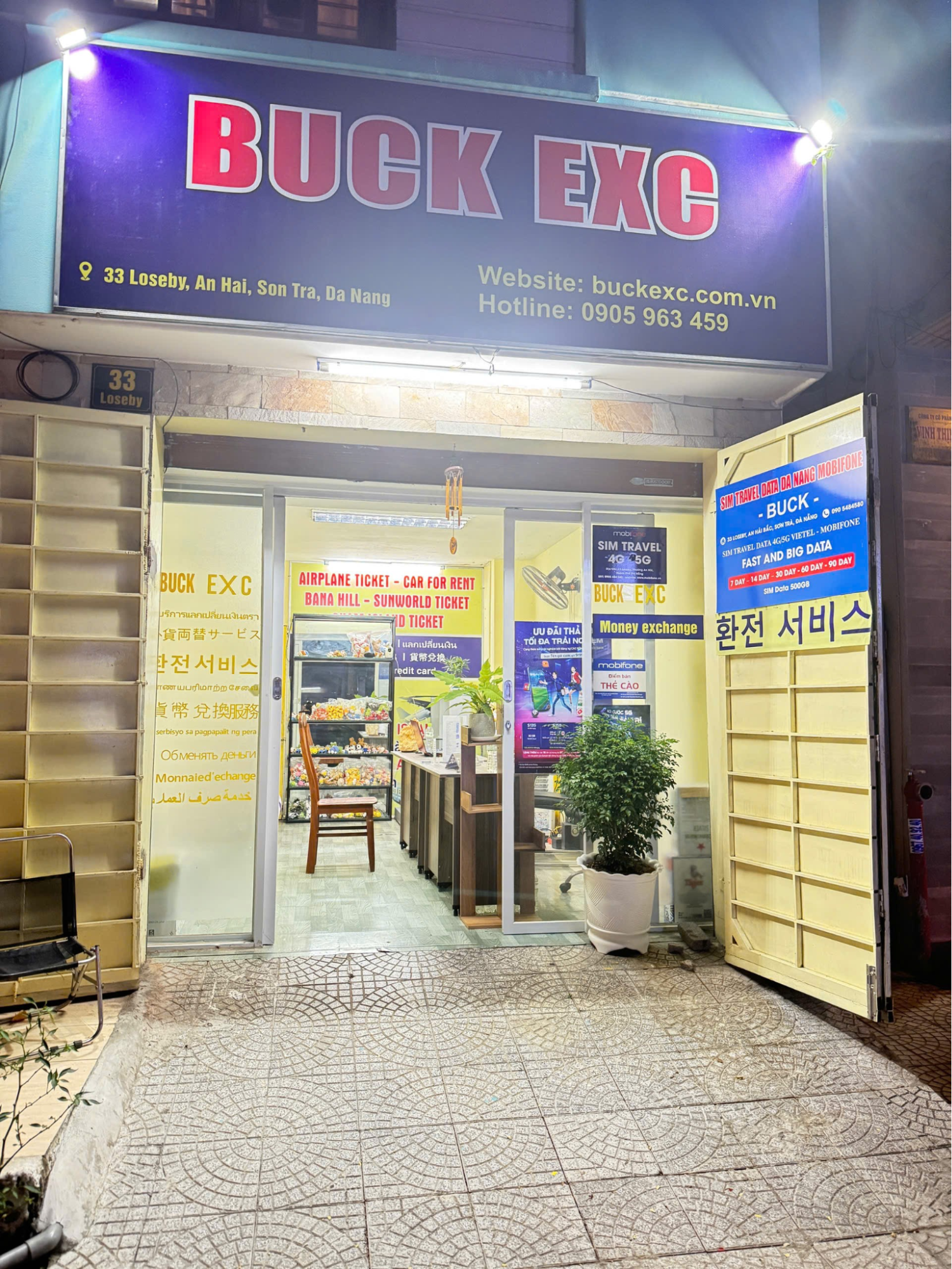

Currency Exchange Offices (Bureaus de Change): Often found at airports, tourist areas, and city centers for convenience.

-

Online Currency Exchange Platforms: Digital services provide competitive rates and easy transactions.

-

ATMs Abroad: Allow travelers to withdraw local currency directly but may include hidden fees.

How Currency Exchange Rates Work

Exchange rates are influenced by various factors:

-

Economic Indicators: Inflation, interest rates, and GDP growth can strengthen or weaken a currency.

-

Market Demand: High demand for a currency increases its value.

-

Political Stability: Countries with stable governments often have stronger currencies.

-

Central Bank Policies: Central banks may intervene to stabilize their currency’s value.

Understanding these factors helps you predict trends and secure better rates when you need currency exchange.

Best Places to Exchange Currency

Finding the right place to exchange currency can mean the difference between saving and losing money.

Banks

Banks are secure and trustworthy, though they may charge slightly higher fees. If you already have an account, some banks provide special rates for their customers.

Local Currency Exchange Bureaus

Independent exchange offices often offer better rates than airports or hotels. However, always compare rates and check for hidden fees.

Online Currency Exchange Services

Modern online platforms and mobile apps allow you to lock in rates, order foreign cash, or transfer funds internationally with transparency and speed.

ATMs Abroad

Withdrawing cash from local ATMs can be convenient but be aware of foreign transaction fees and ATM surcharges.

Tips to Get the Best Currency Exchange Rates

-

Plan Ahead: Exchange currency before traveling to avoid last-minute high fees.

-

Compare Rates: Check rates from multiple providers, including banks and online services.

-

Avoid Airport Exchanges: Airport kiosks often have the worst rates due to convenience charges.

-

Use a Travel Card: Prepaid travel cards lock in exchange rates and reduce hidden fees.

-

Monitor Market Trends: Currency exchange rates fluctuate daily; exchange when rates are favorable.

Currency Exchange for Travelers

For international travelers, currency exchange planning is essential. Carry a small amount of local cash for emergencies, but rely on secure payment methods like credit cards or digital wallets for larger purchases. Notify your bank about your travel plans to avoid card blocks and ensure smooth transactions.

Currency Exchange for Businesses

Global businesses depend heavily on currency exchange. Importers and exporters must manage exchange rate risk to protect profits. Many companies use forward contracts or hedging strategies to stabilize costs when dealing with multiple currencies.

Understanding Currency Exchange Fees

Currency exchange is rarely free. Common charges include:

-

Service Fees: A flat fee for processing your transaction.

-

Commission: A percentage of the exchanged amount.

-

Spread: The difference between the buying and selling rate.

Always ask for a breakdown of these charges to avoid surprises.

Online Currency Exchange: The Modern Solution

The rise of fintech has revolutionized currency exchange. Platforms like Wise, Revolut, and PayPal offer competitive rates, real-time tracking, and quick transfers. These services are especially useful for freelancers, remote workers, and international students who regularly move money across borders.

Currency Exchange Safety Tips

When handling currency exchange, safety is crucial:

-

Exchange money only with reputable providers.

-

Keep receipts for proof of transaction.

-

Avoid carrying large amounts of cash when traveling.

-

Double-check bills for authenticity.

Future of Currency Exchange

With digital currencies and blockchain technology, the future of currency exchange is evolving. Cryptocurrencies like Bitcoin offer an alternative to traditional methods, though they carry volatility and regulatory challenges. Central bank digital currencies (CBDCs) may also reshape how people exchange money globally.

Conclusion

Currency exchange is more than just swapping money—it is an essential part of global travel, business, and financial planning. By understanding how exchange rates work, comparing providers, and using smart strategies, you can save money and avoid unnecessary fees. Whether you are a traveler, an entrepreneur, or someone sending funds to loved ones abroad, mastering the art of currency exchange ensures every transaction is efficient and cost-effective.